During the COVID-19 pandemic, people spent a lot of time isolated and indoors, which helped foster an environment where some people now feel lonelier than ever. The result is a loss of social connectedness—the degree to which people feel the social connections and relationships in their lives to satisfy their wants and needs. When social…

Your Welcoa membership has expired.

Who is Responsible for Workplace Wellness Compliance?

The following article does NOT constitute legal advice and should not be used as such. It is for educational purposes only. Readers should retain legal counsel to obtain definitive answers.

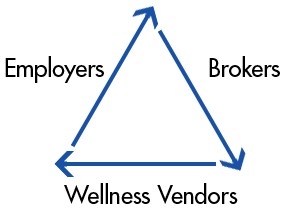

One of the interesting conversations I had at the recent WELCOA Summit in Philadelphia was the dynamic between employers, wellness vendors and brokers when it comes to workplace wellness compliance. My conversations involved individuals who work for all three types of entities and we all agreed that each entity liked to think that one of the other two entities was handling, and thereby responsible, for complying with the various workplace wellness laws. A visual of the varying expectations may look like this:

Although many of my Summit colleagues were aware that many of the laws impacting workplace wellness programs, such as the Americans with Disabilities Act (ADA) and the Genetic Information Nondiscrimination Act (GINA), place the ultimate legal responsibility on the employer, it was agreed that employers often rely heavily on their insurance brokers for compliance guidance. In turn, brokers many times rely on wellness vendors for compliance guidance. Whether insurance brokers or wellness vendors could be held liable in a court of law, should an employee sue for a wellness law violation, may depend on whether and how much the employer delegates compliance to its brokers and/or wellness vendors. This delegation most likely would occur through a contractual arrangement.

Coincidentally, this very issue was tested recently in Indiana. The Seventh Circuit Court of Appeals decided in January 2019 a case involving a lawsuit by an employee against a wellness vendor for an alleged ADA, GINA, Title VII and Age Discrimination in Employment Act (ADEA) violations. The plaintiff, William Dittman, worked for a subsidiary of Xerox, which had hired Quest Diagnostics to conduct health screenings of its employees. The screenings were used to test for tobacco use. Employees who refused to complete a health questionnaire and submit to a wellness screening were assessed a $500 surcharge.

Dittman refused to complete the screening and questionnaire because of privacy concerns. As a result, he had to pay the $500 surcharge. In response, Dittman sued Xerox and Quest Diagnostics. The court immediately dismissed Dittman’s lawsuit against Xerox because Dittman was subject to an employment agreement that required any disputes to be addressed through arbitration. Because of the arbitration agreement, Dittman could not sue Xerox in court.

That left Dittman’s claims against Quest Diagnostics. Dittman tried to argue that because Quest controlled his benefits under the wellness program, Quest was an agent of Xerox and in effect, his employer. The court did not buy that argument because evidence showed that all Quest did was provide wellness screenings and collect medical information. Xerox implemented and assessed the tobacco surcharge, not Quest. Dittman tried to argue that Quest provided Xerox with healthcare information that ultimately affected his wages (i.e., whether he was required to pay the $500 surcharge), but the court responded that “one does not become an employee of an entity just because that entity’s decisions may have some effect on income.” The decision of whether to impose the surcharge rested with Xerox; Quest merely gathered the information that informed Xerox about which of its employees must pay the $500 surcharge.

Because of these facts, the court dismissed Dittman’s lawsuit against Quest Diagnostics. The lessons one can learn from this case are as follows:

- Employers are responsible for workplace wellness compliance under ADA, GINA, Title VII and ADEA.

- Employers can address disputes about workplace wellness compliance through arbitration agreements if such agreements are part of an employee contract.

- Wellness vendors who merely collect health information through screenings and play no larger role in the decision-making about who earns a wellness incentive have a good argument that they are not liable for alleged violations under the ADA, GINA, Title VII or ADEA.

- Wellness vendors or other third parties (like brokers) to whom the employer delegates sufficient control of some traditional rights over employees, such as wages, may be liable for alleged wellness law violations. See e.g., Carparts Distribution Center, Inc. v. Automotive Wholesaler’s Ass’n of New England, Inc. 37 F.3d 12, 17 (1st Cir. 1994).

To sum up, when it comes to workplace wellness compliance, for many wellness laws, employers are the “covered entity” ultimately responsible for complying with those laws. That does not mean, however, that third parties such as wellness vendors or brokers are immune to liability. Third parties may become liable through a contract with the employer and/or when the employer delegates sufficient control to the third party regarding employee rights. As a result, all three types of entities should learn about workplace wellness laws and seek compliance guidance whenever possible.

Barbara J. Zabawa

President of the Center for Health and Wellness Law, LLC

wellnesslaw.com

Health Promotion Program Legal Updates*

Every 3rd Wednesday from 10:00–11:00 AM CT

*This is an exclusive WELCOA Member Resource.